Some of the most important milestones in life depend on a credit score to make them happen successfully. Renting an apartment, buying a home, investing in a car … all of these things and more are credit-rating-dependent. But what is a credit score, and how can you build yours?

In this beginner’s guide, we’ll take the uncertainty out of this part of adulting as we explain what helps and hurts your credit rating, how to keep track of it, and how to boost your score.

Understanding Your Credit Score

Credit scores, or ratings, let potential lenders like credit card companies and banks know how much of a “risk” you are. In other words, if they lend you money, what are the chances of them getting it back in full?

The higher the credit score, the less of a risk it is to loan you money. And since a loan usually comes with interest that the lender receives, people with high credit scores are the ideal borrowers. Creditors “reward” these individuals with lower interest rates and other premier terms, which also attract potential borrowers to one lender over another.

However, high-risk borrowers pay more interest to take out credit or a loan. Your credit rating can either save you money or cost you substantially, depending on the amount you borrow and the interest rate.

Are You a Good Risk or a Bad Risk?

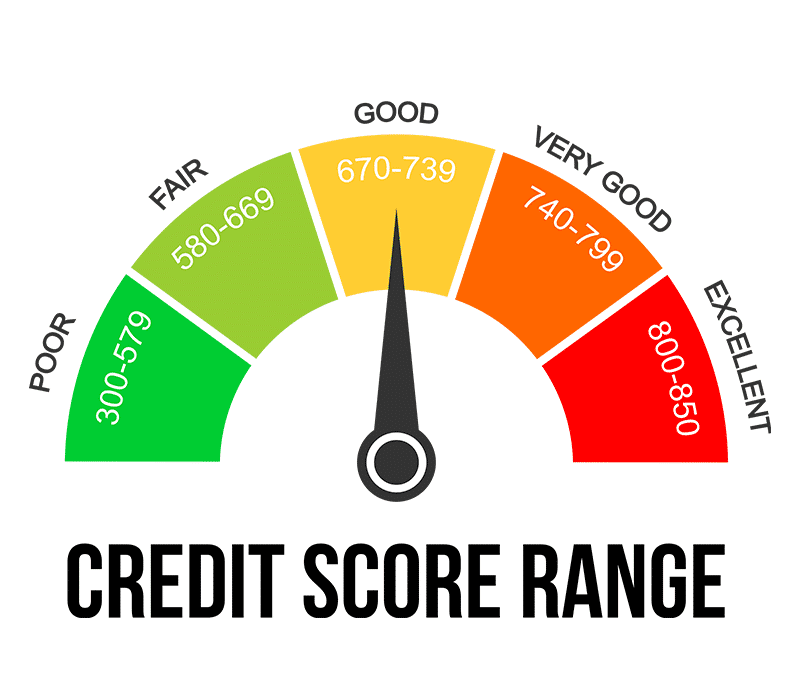

Credit scoring models evaluate the reports that lenders have submitted to the three major credit bureaus — Equifax, Experian, and TransUnion — tracking your repayment history. The data is analyzed and turned into a number (typically from 300 to 850) that is used to predict how likely it is that you would miss a payment by 90 days or longer over the next two years, or how much of a financial risk you are.

Preapproved Versus Prequalified

As you’re shopping around or checking your mailbox, you may see lenders tell you you’re prequalified or preapproved for credit. There’s a significant difference between these two terms.

Credit card and mortgage or auto lenders frequently send letters to people with a predetermined minimum score and other factors. These offers for credit are tentatively prequalified, pending a credit score and financial check. However, a preapproved offer means that your credit risk has already been assessed and approved, and you’ve been given a value of credit and can shop with confidence.

What’s On Your Credit Score?

If you haven’t borrowed money before, you’re probably wondering how you already have a rating. This number can use data like utility bills and bank records to establish your score.

FICO® scores range from 300 to 850. Your score includes information such as:

- Having a credit account six months or older

- Hard inquiries from potential lenders

- Activity over the previous six months

- Collections accounts

- Student, auto, and mortgage loans or inquiries

But what gets confusing is that there are multiple credit scores, and lenders don’t always use the same one.

Because FICO and VantageScore, the two main credit score raters, develop new credit scoring models, your score changes. The number also depends on whether your creditor reported your account or not, which often happens with utility providers and similar creditors.

Building and Repairing Credit Scores

Generally, your credit score stems from a combination of information housed in Equifax, TransUnion, or Experian. While all of this information may not be identical, it consists of the same categories: your payment history (missed and on time payments), total debt (credit utilization), account history, types of credit, and recent activity.

Missed payments of 60 days or longer will hurt your credit score. To build it, keep your accounts open with low balances. Pay them regularly and on time. Keep an eye on your credit utilization. The closer you get to your credit limit, the higher this percentage goes, and it negatively impacts your score. Even if you don’t use a credit card or lender, don’t close the account. Having an account in good standing for a long time increases your score.

Mix your credit accounts up by taking out open installments and revolving credit. This mix helps boost your score. However, your recent hard inquiries may knock the score down a few points. Be cautious about taking out new credit cards or other loans before you make a large purchase, like buying a car or house.

Consider what’s on your credit report before you make major financial decisions to invest. Talk to your advisor about potentially paying off high-interest debt or old accounts, especially if you’re concerned about the impact of debt on your beneficiaries. OJM Group’s article on asset protection explains how to protect your loved ones from creditors after you pass.

Conclusion

Financial health is a goal for most of us, but it starts with understanding how your credit score can help or hurt you. With a good credit rating, you can shop around for the best interest rates, make strong investments, and save the money you’d have paid on interest to improve your quality of life.